|

We are going out on a limb at the risk of being wrong and stating that we “believe” that the global equity markets are more volatile than average. Phew, it’s tough taking a stand. The basis for our bold declaration can be seen in some recent comments from a few financial publications: "So far, 2016 has been something of a disaster around global markets." "Wall Street Rises After a Brutal Week"

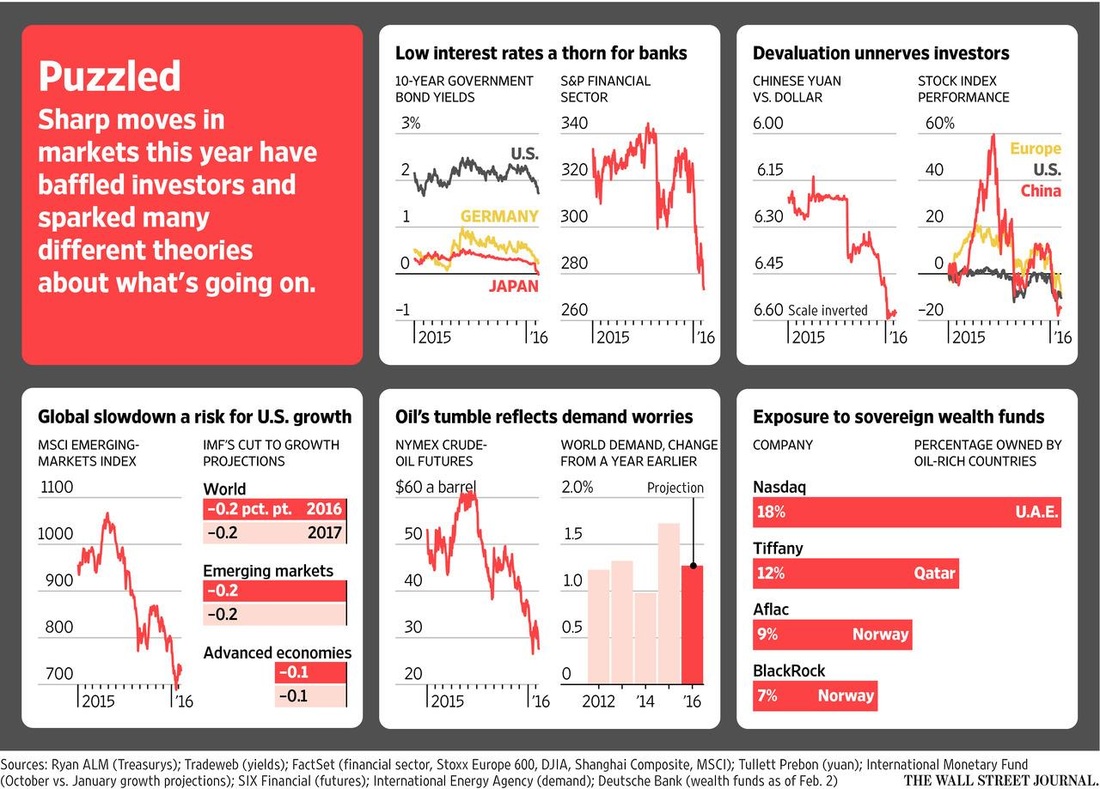

"There's a confluence of bad news around the world that really shakes investor confidence." It seems that the proverbial limb on which we stand is simply a twig on the ground that we’re stepping on, but it’s easy to see how we could be a little short on conviction. As most of you are aware, financial articles and media are notorious for declaring reasons for stock and bond market fluctuations. Today’s Wall Street Journal boldly declares “Stocks Move Higher as Oil Prices, Banks Rally.” Many in the financial press can be excused from sounding so definitive when stating the causes of market movements. While they would be admired by some to state something like “It’s a busy day in the markets; I’m not sure why, but it’s busy.” Would you, the reader want to read more? We know it’s tough to sound less certain, but the Economist recently posted an article that listed five potential causes for the decline over the past month or two. These reasons are shown in the following illustration: The main takeaway from these potential causes is that it’s not unusual that investors and analysts are uncertain. In fact, it’s normal. This is also the reason why the markets can make an unexpected turn upward. The operative word is "unexpected.”

The one principle that we believe is that it’s primarily a matter of timing. Yes, markets have declined. No, we’re not sure if it will rebound next week, next month or next year. We feel confident that the reallocation of resources that Mike discussed at the recent breakfast is continual and perpetual. It WILL get better.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorsOccasionally we like to post articles that give you some insight into how we form our opinions or stay informed. Archives

May 2021

Categories

All

|

3778 Plantation River Drive Suite 102, Boise, ID 83703 | Telephone 208-853-6980 | Fax 208-853-6982

RSS Feed

RSS Feed