Financial Planning

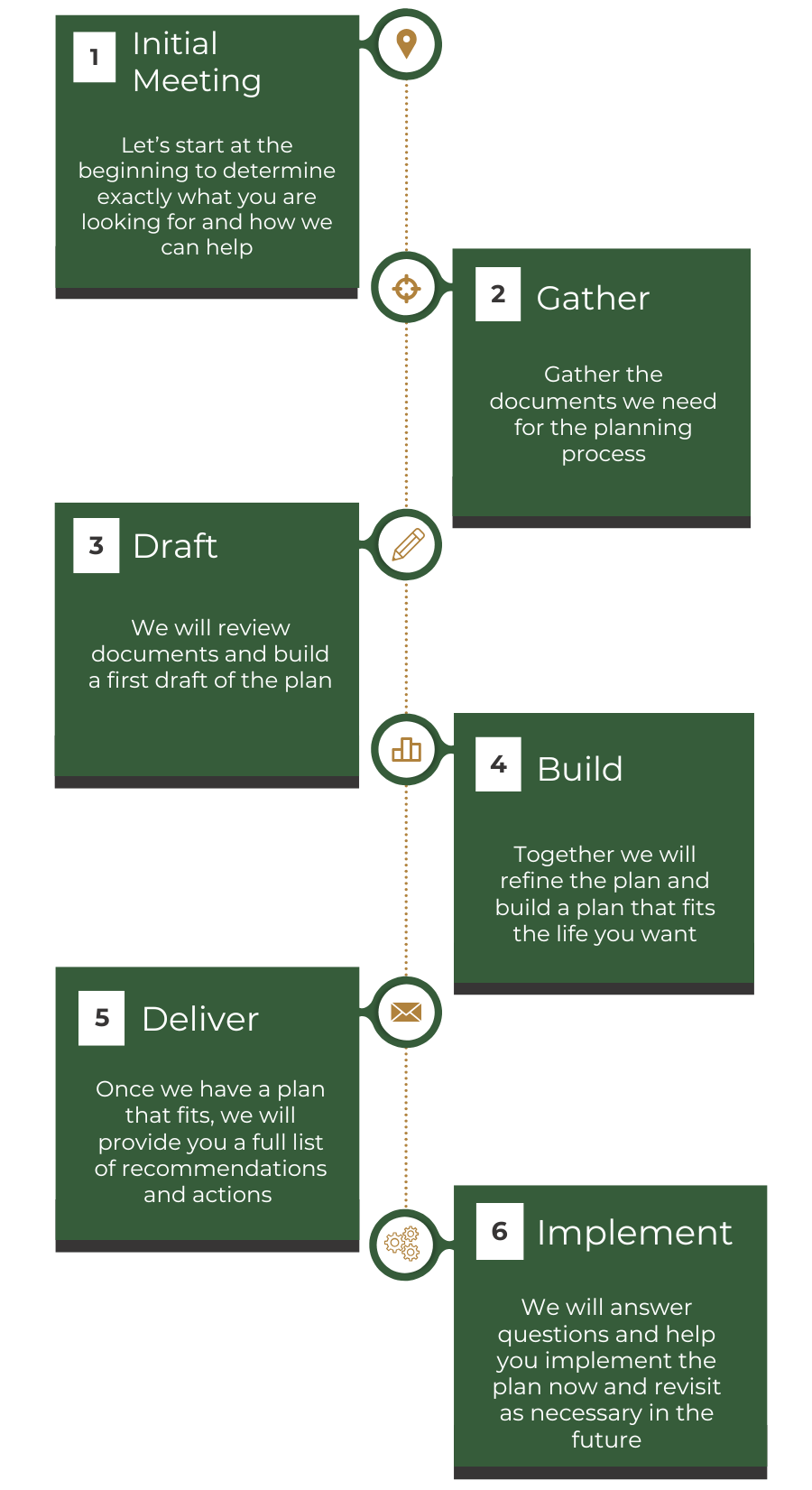

Financial planning is integral to our services because so much of what we do comes back to your financial goals. Our financial planning process helps you take your financial goals from vague constructs to specific, measurable outcomes. Our goal is to help you uncover your personal definition of success with your finances.